What Q1 earnings indicate about future acquisition activity

One year ago, companies across the construction materials industry released their first quarter results for 2020. Although the timing of COVID-19 had minimal impact on first quarter earnings, the uncertainty it brought was notable, highlighted by the management commentary that accompanied otherwise strong first quarter earnings.

They referenced safety protocols, contingency plans, and liquidity concerns. They highlighted their inability to forecast future results, withdrew their earnings guidance for the remainder of 2020, and laid out plans to reduce expenses, preserve capital, suspend acquisitions, and curtail growth initiatives. They also encouraged investors to focus on their long-term positioning as they rode out the anticipated short-term volatility.

A year makes a big difference

Over the past several weeks, industry companies released their results for the first quarter of 2021. Not only did most organizations report record results, but the accompanying commentary reflected markedly optimistic views for the balance of 2021 and beyond. Gone were trepidations about future earnings and cash reserves, replaced by confidence in recovering markets and strong balance sheets. Consider:

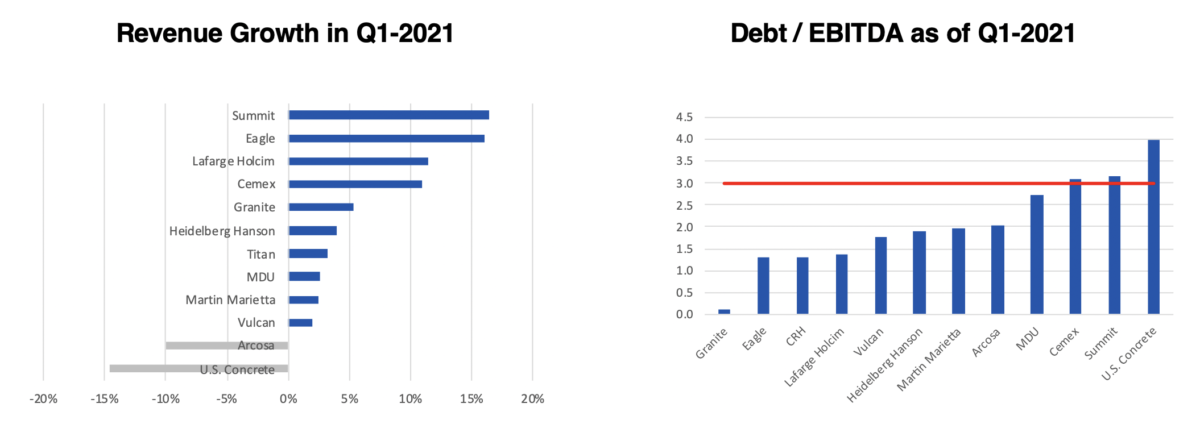

- 83% of publicly traded producers in the industry reported both revenue and earnings growth in Q1-2021 compared to the same quarter in 2020, with median revenue and EBITDA increases of 3.6% and 28.3%, respectively

- 50% of producers reported long-term debt below 2.0x EBITDA; an additional 25% reported leverage less than 3.0x EBITDA. These companies also reported cash on hand totaling more than $15B at the end of Q1, meaning that three quarters of large producers have ample cash and excess debt capacity to fund future growth initiatives

- 100% of producers in the industry expressed a positive outlook for 2021, expecting full-year earnings to be at or above levels reported in 2019 and 2020. This view was expressed even by producers who under-performed in the first quarter of this year

Acquisition activity on the rise

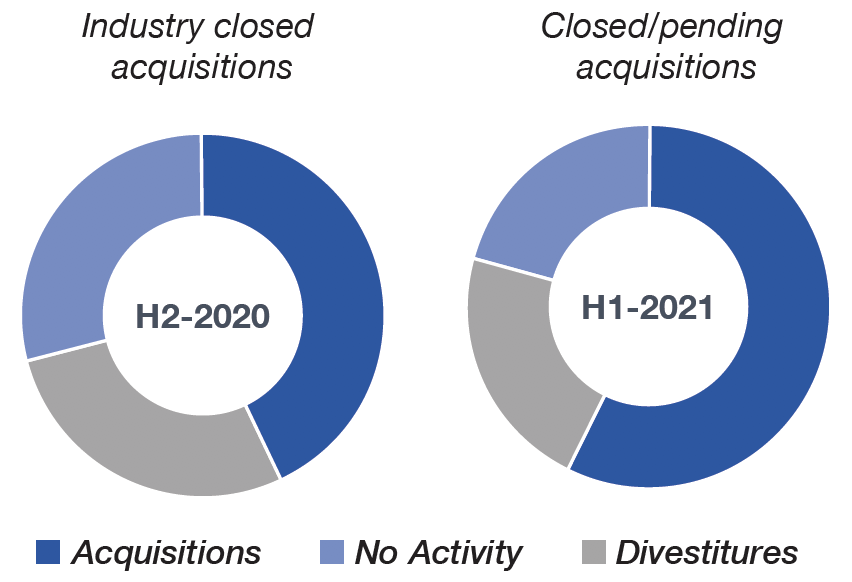

Impressive financial results from across the industry, coupled with strong balance sheets and a uniformly positive outlook, are driving a measurable increase in acquisition activity. Nearly 60% of large producers either have closed or expect to close one or more acquisitions in the first half of this year, representing a substantial increase from the second half of 2020.

Although the acquisition preferences of these buyers still vary by size, geography, and product line, this industry-wide uptick in M&A activity is a welcome development, as it reflects broad optimism that these prosperous times will continue.

If recent performance holds, buyers will find no shortage of acquisition targets that are well positioned to deliver strong results now and in the future. And sellers with the right profiles will find no shortage of well-heeled suitors. All-in-all, 2021 is shaping up to be a banner year.

About the author:

Gregory Dayko is founder of Inlet Capital Group and is responsible for its M&A and strategy consulting practices. He can be reached at gdayko@inletcapitalgroup.com or 561-529-5569.

Gregory Dayko is founder of Inlet Capital Group and is responsible for its M&A and strategy consulting practices. He can be reached at gdayko@inletcapitalgroup.com or 561-529-5569.