Can Martin Marietta’s acquisition spree continue?

Yet another transaction involving Martin Marietta has been completed, with the company’s $2.3B acquisition of Lehigh-Hanson’s west division closing this month. The deal included 2 domestic cement plants, 13 cement terminals, 29 ready-mix plants, 15 asphalt plants, and 17 aggregate locations with nearly 300M tons of reserves. The transaction continues an acquisition-forward trend for Martin Marietta, who began 2021 with a positive outlook and a stated intent to use acquisitions to expand into new markets and strengthen its positions in existing markets.

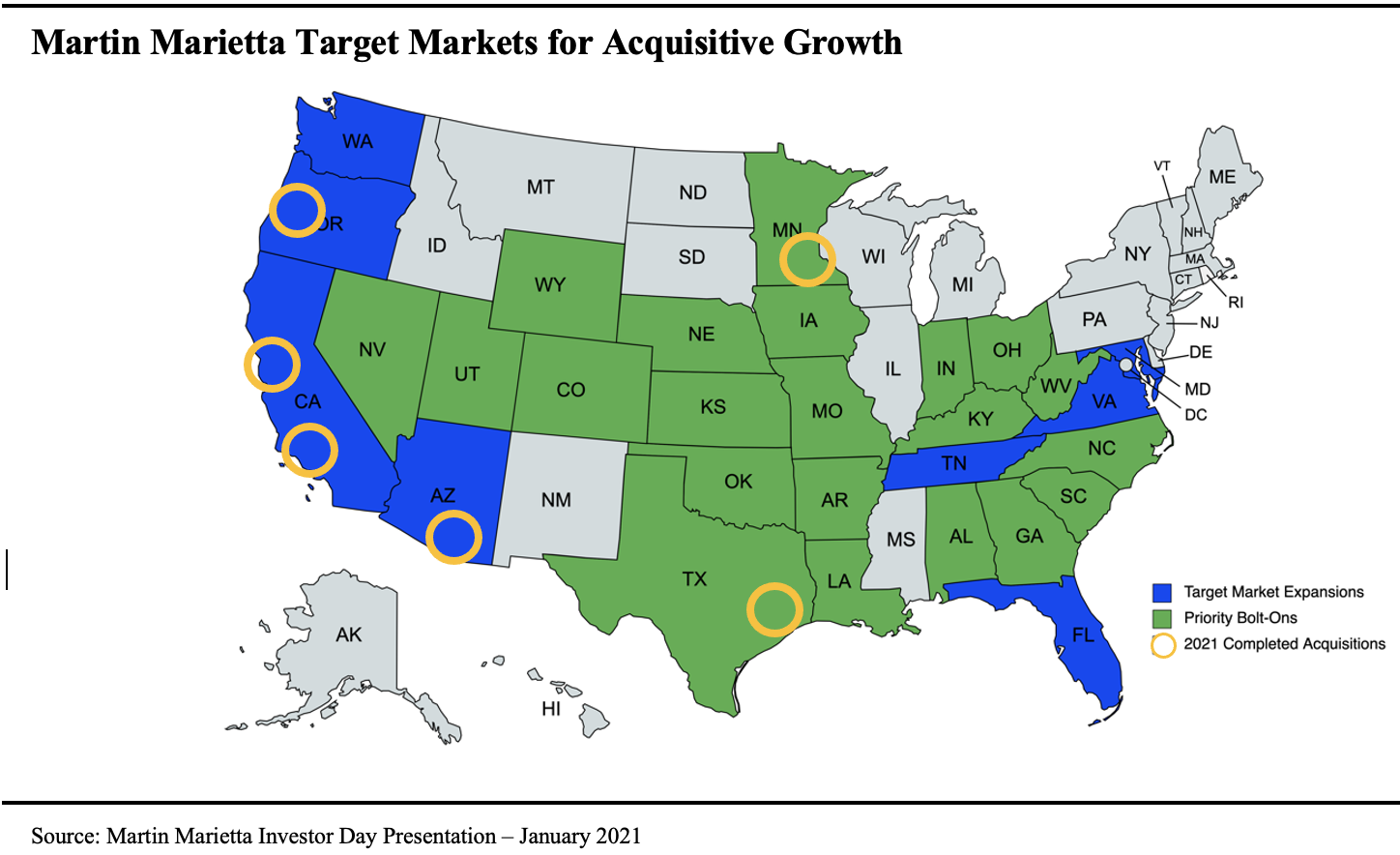

Since then, the company has executed this strategy with military precision, closing three major acquisitions, including Lehigh-Hanson, Tiller, and Southern Crushed Concrete. Collectively, these transactions rounded out Martin’s product offering in Texas, enabled a market-leading position in Minnesota, and provided entry into the high-growth Arizona market and the high-barrier-to-entry California market.

These investments not only give Martin Marietta large-scale market positions around which it can build, but they also continue the company’s transition from aggregates pure-play to vertically-integrated producer, and a formidable one at that. In 2010, construction aggregates accounted for approximately 83% of Martin Marietta’s revenues. By 2020, that number had dropped to ~56%. After the company integrates its 2021 acquisitions, its revenues will be nearly 4x larger than in 2010, and aggregates will account for only 50% of Martin’s overall revenues.

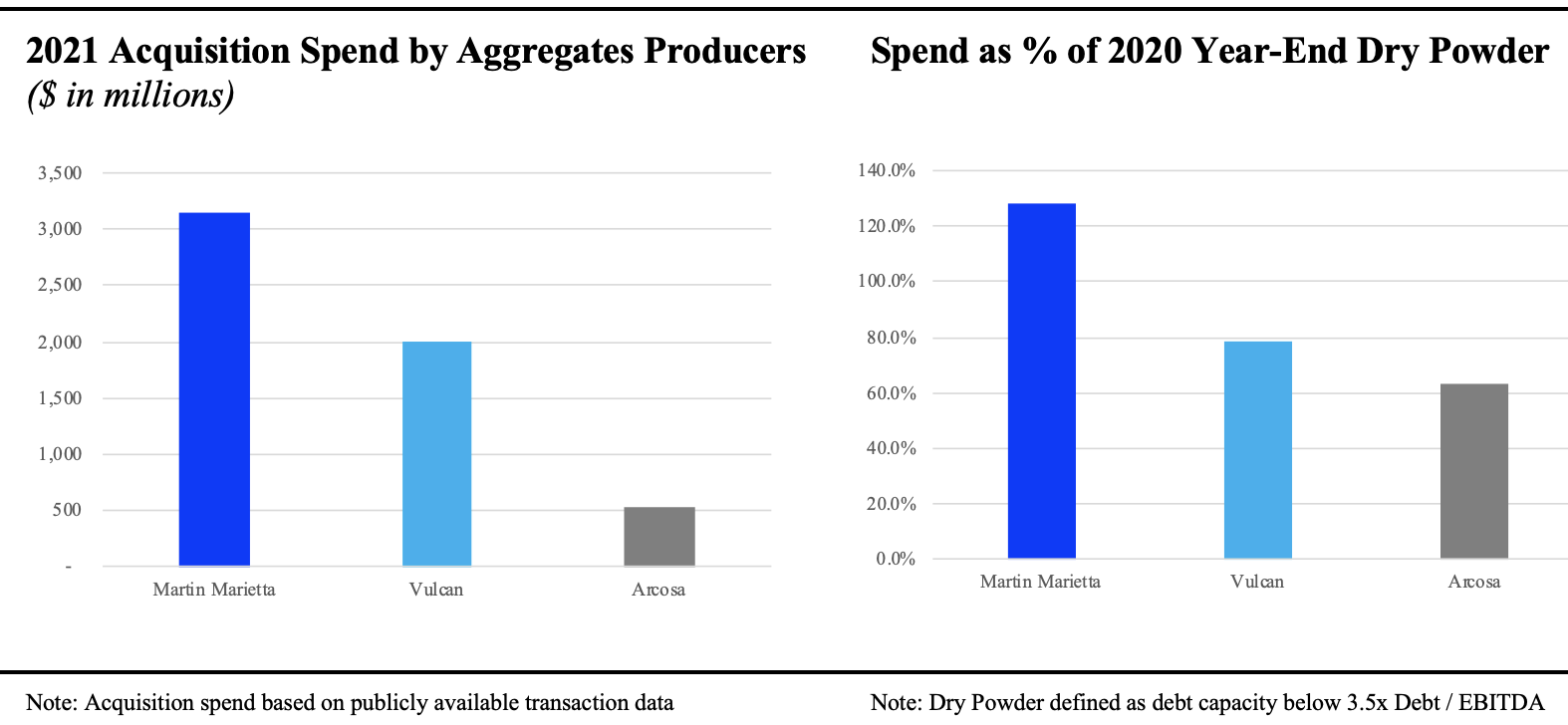

But this transitional growth comes at a price. From 2010 through 2020, Martin Marietta completed $4.8B in acquisitions but skillfully managed its balance sheet and simultaneously amassed $2.5B in dry powder to fund future acquisitions. In 2021, however, the company depleted virtually all of this dry powder (and then some), deploying $3.2B on acquisitions, far more than any of its peers. Martin Marietta’s track record of extracting maximum value from its acquisitions and rapidly deleveraging is well established, but its 2021 spending spree may leave the company with a bit of a hangover, at least in the short-term.

So why does this matter?

Typically, there is a flurry of bolt-on activity after a large platform acquisition, as the buyer seeks to clean up its markets and maximize synergies. This effect can be amplified in markets where multiple platform acquisitions have occurred, as competition for bolt-on deals pushes values upward. Such would normally be the case in California and Arizona, where Vulcan and Arcosa have also recently closed large transactions.

But Martin’s balance sheet is stretched, for the time being at least, so it may need to be especially deliberate in its bolt-on program as it focuses on reducing leverage. Vulcan and Arcosa, on the other hand, have kept some of their powder dry, giving them a key advantage as they look to begin consolidating their new markets. In markets where these two groups have recently made a splash, prospective sellers can expect to find eager buyers and increased transaction activity. In most other markets, however, M&A activity, especially larger transactions, may slow, as Martin takes a breather and its rivals focus elsewhere.

About the author:

Gregory Dayko is founder of Inlet Capital Group and is responsible for its M&A and strategy consulting practices. He can be reached at gdayko@inletcapitalgroup.com or 561-529-5569.

Gregory Dayko is founder of Inlet Capital Group and is responsible for its M&A and strategy consulting practices. He can be reached at gdayko@inletcapitalgroup.com or 561-529-5569.