Transaction Advisory

Inlet Capital Group helps clients buy, sell, or invest in assets, real estate, reserves, and operating companies. We offer a comprehensive scope of services, and we can tailor those services to provide as much or as little assistance as necessary.

Our sell-side advisory practice takes many forms, but generally involves the sale of all or a portion of a business to an industry buyer or financial investor. To ensure a smooth sale process, we complete several key steps upfront:

- Develop a high-level valuation, so clients can understand what range of values they might expect in a sale

- Conduct preliminary diligence to uncover any notable issues

- Develop materials describing the business and its investment merits

- Identify the right group of prospective purchasers/investors and the optimal approach

From there, we manage and/or coordinate all aspects of the transaction, including investor communications, solicitation of proposals, buyer due diligence, transaction structuring, agreement negotiation, and closing. Our proven methodology allows transactions to run smoothly, close quickly, and yield the highest value.

Our buy-side advisory practice is intended to help clients execute acquisitions that create value. We offer a suite of services that allow us to provide as much or as little assistance as our clients require, including:

- Target market evaluation, including the identification of potentially attractive markets via high-level screening, followed by detailed study

- Acquisition candidate identification, including estimates of the size, earnings, value, and amenability to a potential acquisition

- Acquisition target approach, in which we make initial overtures, obtain key information, value the target, and structure a non-binding proposal

- Due diligence, including a detailed review of the target company and the sustainability of its earnings

Our capital advisory practice is intended to help clients secure the capital necessary to optimize their balance sheets and execute their growth plans. Acquiring a competitor, building a new facility, buying out a partner, and acquiring real estate or reserves. We understand what type of capital is suitable for these and other situations, and we have access to a vast network of banks, junior capital providers, equity sponsors, and other financial investors with a demonstrated willingness to invest in the industry. We help clients identify and install optimal capital solutions with the right terms.

OTHER SERVICES

Strategy Consulting | Lender / Sponsor Advisory

Where We Operate

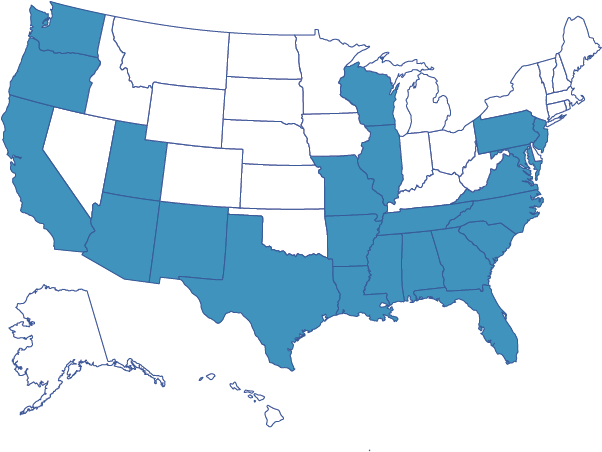

Inlet Capital Group is headquartered in Jupiter, Florida. We most frequently engage with clients throughout Florida and the Southeast, but we have also completed client engagements throughout the United States. If you’d like to know about our coverage criteria, please call us at 561-529-5569 or send us an email. The following map is a sampling of our engagement locations.