Q2 earnings roundup

Three months ago, companies across the construction materials industry reported blowout earnings for Q1-2021. Eighty-three percent of publicly traded producers saw both revenue and EBITDA growth in the first quarter, and 100 percent conveyed a positive outlook for 2021, expecting full-year earnings to surpass the record levels of 2019 and 2020. These strong results and positive sentiment were accompanied by strong balance sheets, with 75 percent of producers reporting debt capacity sufficient to fund acquisitive growth and 60 percent expressing their desire and/or intent to do so.

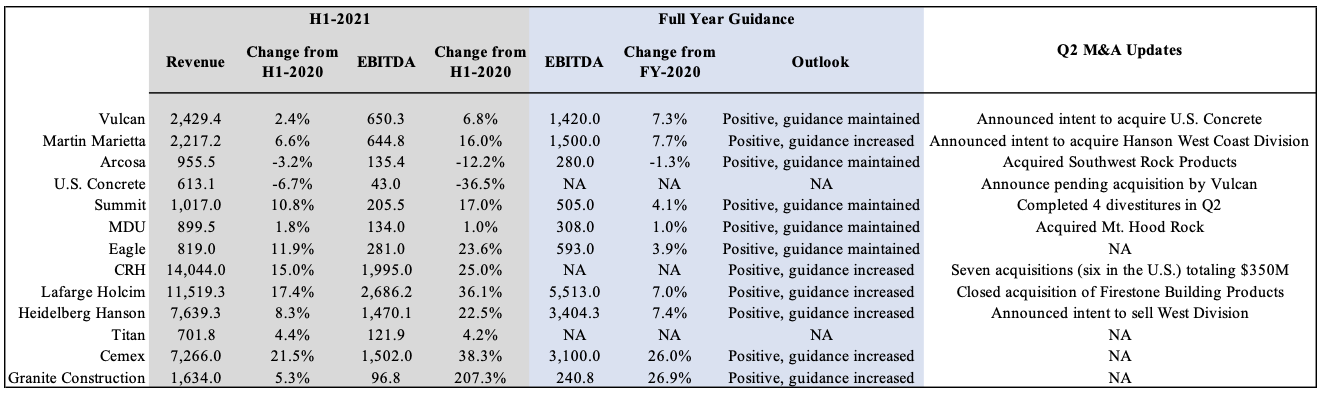

In the second quarter, sentiment turned into reality, as multiple producers announced and/or closed transactions in furtherance of their growth objectives. Although Martin Marietta and Vulcan grabbed headlines with their respective announcements of multi-billion dollar deals, many others made acquisitive moves, including Arcosa, New Frontier, and Knife River. Summit also invested for growth, deploying proceeds from non-core divestitures into greenfield quarries in key southeastern markets.

While this risk capital reflected continued optimism and an appetite for growth, it discounted several headwinds that have the potential to blunt the current economic expansion. Labor shortages, inflationary pressures, uncertainty surrounding the infrastructure bill, and a resurgence of COVID all represent possible impediments to the enduring strength of the sector. Can H1 results reveal insight about where the sector is headed?

Eleven of thirteen companies reported growth in the first half of 2021, with median revenue and EBITDA increases of 6.6 percent and 17 percent, respectively. Further, of the companies providing full year earnings outlooks for 2021, five maintained their previous guidance, while six increased their earnings forecasts, with full-year earnings projected to grow an average of 9 percent in 2021.

After delivering record earnings, strong balance sheets, and positive outlooks in Q1, the industry added even more growth in Q2, seeing little impact from any budding economic headwinds. By any measure, the first half of 2021 was a resounding success. With positive sentiment and continued growth projected for the second half, the sector is poised for another outstanding year.

About the author:

Gregory Dayko is founder of Inlet Capital Group and is responsible for its M&A and strategy consulting practices. He can be reached at gdayko@inletcapitalgroup.com or 561-529-5569.

Gregory Dayko is founder of Inlet Capital Group and is responsible for its M&A and strategy consulting practices. He can be reached at gdayko@inletcapitalgroup.com or 561-529-5569.