Greenfields: The consequence of consolidation

Economists use the term excess profit to describe monopolistic or oligopolistic markets in which incumbent producers generate earnings above and beyond those that yield adequate risk-adjusted returns on capital. In competitive markets, excess profits are viewed as unsustainable; they tend to attract new competitors, eventually compressing margins to normalized levels. They’re great while they last, but they don’t last long.

Said more simply……pigs get fat, hogs get slaughtered.

The construction aggregates industry has seen wave after wave of consolidation, with fewer and fewer operators controlling ever increasing shares of local and regional markets across the U.S. As the positions of the industry leaders have grown in these markets, so too have their profits.

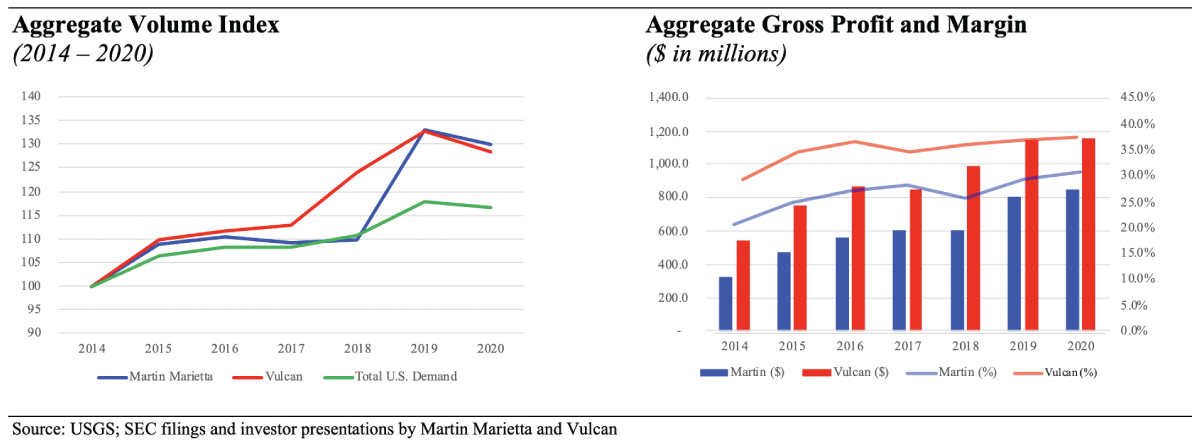

The financial performance by these and other industry leaders has been impressive. Seeing gross profits more than double over the past several years, and aggregate margins expand to 30%, 40%, and beyond in some markets, Martin Marietta, Vulcan, and other large producers have certainly seen their commercial strategies validated. With their share prices at all-time highs, they’ve launched yet another round of consolidation in the industry. They’ve pushed acquisition multiples into the teens, postulating that high barriers to entry and few viable acquisition targets in attractive markets justify a “scarcity premium” on buyouts in high-growth regions.

The question is this: is this sustainable, or will the excess profits in the aggregates industry succumb to economic theory?

Barriers to entry in the mining business can be high. Finding deposits of sufficient quantity and quality proximate to attractive markets is often akin to chasing unicorns. Even when found, public opposition to new mines, arcane zoning ordinances, and extensive bureaucracy at the local, state, and federal levels drive years-long permitting timelines and cost hundreds of thousands, if not millions of dollars. To say nothing of the capital and expertise required to successfully navigate site development, plant construction, startup, and market entry for a new quarry.

But high margins and double-digit acquisition multiples have a way of motivating people. More groups than ever are now considering, pursuing, or building new quarries across the nation. In a 2021 survey of 16 large producers in the U.S., 11 responded they are considering or are open to greenfield opportunities. Six of those stated they would consider a greenfield quarry as a primary means to enter a new market.

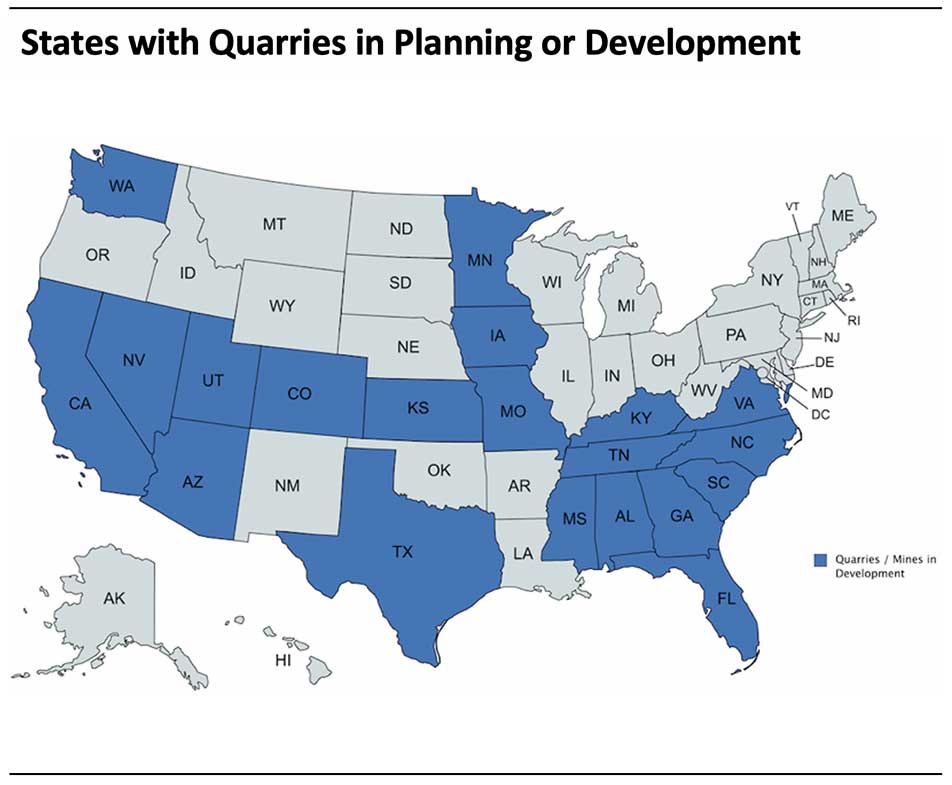

With greenfield sentiment this positive, it follows that quarry development activity has seen a strong recent uptick. At least 20 states are home to greenfield opportunities currently in planning, permitting, development, or construction, with multiple permitted sites presently available for acquisition.

Many of these new operations are needed, located in sunbelt states and other areas whose populations are projected to surge, and whose long-term aggregate demand can’t be met by existing supply. But in the short-term, these facilities have the potential to adversely impact their respective markets.

The direct effects are obvious and notable: price erosion in aggregates and a shuffling of supply relationships, as new entrants seek to establish their place in the market, enticing customers with discount pricing and promises of priority service. History has shown the resulting turf wars can last longer and cut deeper than anyone anticipates, bringing a swift and decisive end to the excess profits that attracted the new entrants in the first place.

History also shows there are indirect effects, which can be just as troublesome. New quarries tend to attract new asphalt and ready-mix competitors, often as captive onsite producers, destabilizing pricing in those segments. Some downstream producers may even use this new “cheap aggregate” to gain share for themselves. And the overall impacts are often not limited to one market, as incumbent producers “hit back” in other markets for maximum effect.

But the news isn’t all bad. The industry is enjoying record profits with strong projected growth, buoyed by robust residential demand and a potential surge in infrastructure spending. A full pipeline of opportunistic greenfields is an inevitable consequence of this success. Although these new operations have the potential to be disruptive, just how disruptive will depend on several factors, including how:

- New producers manage their pending entries

- Incumbent producers respond

- Aggregate consumers utilize this new supply

- Demand adjusts to accommodate this additional capacity

Next month, we’ll explore one potential strategy that incumbents and consumers might employ to mitigate the adverse effects of new quarries in their markets.

To review this and other potential mitigating strategies in advance of that, contact Inlet Capital Group directly or click here to learn more.

About the author:

Gregory Dayko is founder of Inlet Capital Group and is responsible for its M&A and strategy consulting practices. He can be reached at gdayko@inletcapitalgroup.com or 561-529-5569.

Gregory Dayko is founder of Inlet Capital Group and is responsible for its M&A and strategy consulting practices. He can be reached at gdayko@inletcapitalgroup.com or 561-529-5569.