Grading the Vulcan – U.S. Concrete Deal

Win-win. In today’s zero-sum culture, in which it often seems there must be a loser for there to be a winner, win-win seems like a quaint relic from a bygone era. But is it? The first half of 2021 has seen a flurry of large transactions that attracted headlines throughout the industry.

From a distance, some of these certainly appear to fit the zero-sum mold. But what about Vulcan’s pending acquisition of U.S. Concrete? Is there a clear winner?

Let’s examine from both perspectives.

U.S. Concrete

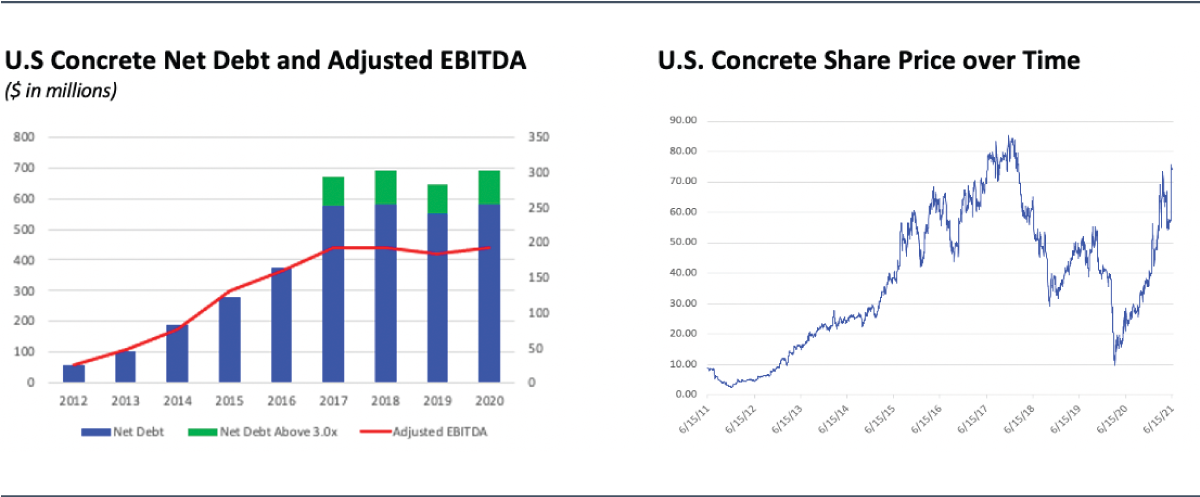

From 2011 through 2016, U.S. Concrete was a growth machine, deploying nearly $440M on acquisitions and increasing EBITDA twentyfold, from $8M to $160M. During that time, the company saw its share price rise from $3 to $66.

By 2017, U.S. Concrete’s EBITDA had increased to more than $190M, with its stock price peaking above $83 per share. But the company soon saw its earnings flatten, with increased competition in legacy markets exerting pressure on both volumes and margins. Further, U.S. Concrete’s net debt had risen above comfortable levels, thus limiting capital available for meaningful growth. No longer a reliable growth engine, U.S. Concrete saw its share price plummet, bottoming below $10 per share in 2020.

The company’s share price partially recovered, a function of its strong positions in solid markets. But its perceived attractiveness as a potential takeover target also played a key role, and the 29 percent premium Vulcan offered relative to the June 4 closing price validated that belief.

Ultimately, the deal rewarded U.S. Concrete shareholders with a value within 12 percent of the stock’s all-time high, despite four years of flat earnings and a still-limited balance sheet. By any measure, that’s a win for U.S. Concrete.

Vulcan Materials

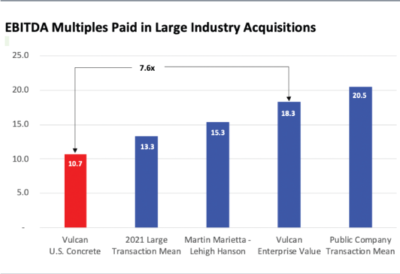

If this is a win for U.S. Concrete, did Vulcan lose? As of March 31, 2021, U.S. Concrete’s trailing twelve-month EBITDA was $187M, and the total value of the transaction is approximately $2.0 billion. That means Vulcan paid 10.7x EBITDA to acquire a vertically integrated aggregates and ready-mix producer with leading positions in Texas, California, and New York.

The multiple Vulcan is paying is lower than the average of other large industry transactions in 2021, lower than other acquisitions of publicly traded companies in the industry, and lower than Vulcan’s current implied multiple. And that’s before synergies are factored in.

And there are plenty.

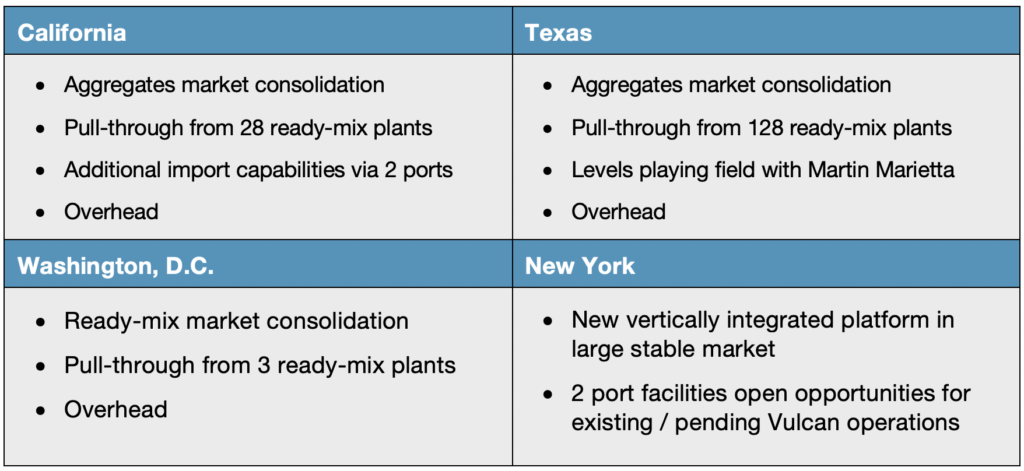

On the surface, Vulcan is buying nearly $190M in EBITDA, supported by 270M tons of reserves, 13M tons of aggregates production, and 8M cubic yards of ready-mix. But they are also getting consolidation, pull-through, and overhead synergies in three core markets, as well as a brand-new platform well suited to utilize Vulcan’s waterborne aggregates. And they’re getting it all for a multiple that is astonishingly low by today’s standards. This transaction is a clear example of deal-making at its best, in which both parties saw opportunities to improve their positions and moved to optimize their own outcomes. Win-win, indeed.

About the author:

Gregory Dayko is founder of Inlet Capital Group and is responsible for its M&A and strategy consulting practices. He can be reached at gdayko@inletcapitalgroup.com or 561-529-5569.

Gregory Dayko is founder of Inlet Capital Group and is responsible for its M&A and strategy consulting practices. He can be reached at gdayko@inletcapitalgroup.com or 561-529-5569.